From the sun-soaked beaches of the Mediterranean to the cosmopolitan streets of London and Paris, Europe stands on the cusp of a remarkable post-pandemic resurgence.

The resurgence of tourism is expected to significantly contribute to global economic growth, driving GDP and job creation across various regions. Despite one of the most challenging periods in global travel history, the continent has shown an exceptional capacity to adapt and flourish, with experts predicting it will not only restore its pre-pandemic prominence but potentially surpass it by 2025. Travelers are once again eager to explore Europe’s myriad cultural treasures, scenic landscapes, and culinary delights—driving renewed demand for authentic experiences and sustainable, value-oriented getaways.

Below, we dive into the data and insights that underscore Europe’s ongoing transformation into a travel powerhouse, including emerging trends, key destinations, and the far-reaching economic impact that shapes local communities and international markets alike.

A Look Back: How Far We’ve Come

Pre-Pandemic Highs (2019)

Europe welcomed 743.91 million tourist arrivals in 2019—an all-time record. International tourist arrivals reached a record high, illustrating the continent’s popularity among global travelers. Tourism contributed significantly to various national GDPs, with France, Spain, and Italy ranked among the top global destinations.

Pandemic Setbacks (2020)

In 2020, tourist arrivals plunged to 239.63 million, with the biggest drops observed among residents of Slovakia, Latvia, Ireland, and Slovenia (all recording less than half as many trips compared to 2019). Across 19 EU Member States, total tourism expenditure fell from €396 billion in 2019 to €181 billion in 2020—a stark reduction of €215 billion. Air travel saw the steepest decline at 71% fewer flights.

Recovery Trends (2021–2023)

By 2022, European tourist arrivals rebounded to 594.53 million, roughly 80% of pre-pandemic levels. According to the European Travel Commission (ETC), the first half of 2023 saw a continued uptick in arrivals, with some Mediterranean destinations nearing or even surpassing 2019 levels. Forecasts for the UK project over 35 million overseas visits in 2023, potentially surpassing 2019 spending levels, while flight capacity across major European airports reached 90% of 2019 figures by mid-2023.

The World Tourism Barometer highlights the importance of inbound tourism in understanding these recovery trends. The ETC also estimates that inbound arrivals to Europe from the U.S. were at 85% of 2019 levels by summer 2023, with expectations of full recovery—and potentially exceeding pre-pandemic volumes—by 2024 or 2025. Furthermore, the average length of stay appears to be slightly increasing, as remote work and “bleisure” travel gain traction.

European Tourism Industry

The European tourism industry remains a cornerstone of the region’s economy, with countries like Croatia leading the charge. In 2022, tourism accounted for a staggering 25.8% of Croatia’s GDP, the highest in the European Union. This trend is set to continue, driven by a growing appetite for travel and tourism across the continent. Recent statistics reveal that Europe welcomed approximately 40.3 million foreign visitors in March 2023 alone, underscoring the sector’s robust recovery.

Spain continues to be a top destination, attracting over 71.66 million international visitors in 2022. This resurgence in European tourism is not just a return to normalcy but a leap towards new heights, fueled by the continent’s rich cultural heritage, diverse landscapes, and unparalleled hospitality.

International Travel Trends

International travel trends are increasingly leaning towards sustainable and responsible tourism practices. A recent survey highlighted that 61% of travelers still prefer visiting Europe’s iconic cities and landmarks over lesser-known destinations. Interestingly, overtourism does not seem to be a significant deterrent, with only 5% of respondents indicating they would change their travel plans due to crowded spots.

Spending habits also vary, with Americans showing a more conservative approach; only 33% are willing to spend upwards of €200 per day. This shift towards mindful spending and sustainable travel reflects a broader trend of travelers seeking value and meaningful experiences over sheer extravagance.

2025 Outlook: On the Road to Full Recovery and International Tourist Arrivals

Tourist Arrivals Surpassing Pre-2020 Levels

Industry experts, including the UNWTO, anticipate that 2025 will see Europe not just return to but potentially exceed 2019 arrival numbers. As of 2023, visits to the UK have already reached 88% of 2019 volumes (24.1 million vs. 27.3 million), reflecting a broader European trend toward nearly complete recovery.

Shifts in Traveler Preferences

With inflationary pressures persisting, travelers continue to seek maximum value for money. Expect a rise in:

Budget-friendly itineraries balancing cost with quality experiences.

Second-city tourism, where travelers skip major urban hubs for smaller, less-crowded (and often cheaper) locales.

Workation setups, as professionals blend work commitments with leisure travel, extending trips and exploring off-peak destinations.

Despite a decline in long haul trip intentions, many travelers still plan to explore distant destinations, reflecting changing travel preferences.

Steady Increase in Spending

Data from the World Travel & Tourism Council (WTTC) shows strong rebound patterns across Europe:

In the UK alone, overseas visitors spent £2.7 billion in June 2022. Spending levels in 2023 are expected to outpace those of 2019 due to pent-up demand and inflationary price shifts. A significant portion of this spending is attributed to domestic tourism spending, which remains a crucial component of the overall tourism revenue.

Europe-wide tourism expenditure has grown steadily since 2021, propelled by increased flight connectivity and travelers’ desire for international experiences. By 2025, total tourism receipts could meet or exceed the €396 billion pre-pandemic peak.

Top Destinations and Emerging Hotspots in European Tourism

Perennial Favorites

France remains the world’s top tourist destination, with Spain, Italy, and Germany close behind. Their UNESCO World Heritage sites, diverse gastronomic offerings, and cultural events continue to draw millions of visitors each year. The Middle East has also seen remarkable growth, with countries like Qatar and Saudi Arabia attracting increasing numbers of visitors.

Least-Visited Gems

While many destinations approach or exceed pre-pandemic arrivals, some smaller nations remain relatively undiscovered. San Marino, Liechtenstein, and Moldova—in their unique geographical or cultural niches—may well see accelerated growth in 2025 as tourists seek off-the-beaten-path experiences.

European Travel Habits and Statistics

European travel habits and statistics reveal a diverse array of motivations for visiting the continent. Tourists flock to Europe for its rich cultural heritage, stunning natural beauty, and vibrant entertainment options. According to recent Europe statistics, the top five EU countries for visitors are France, the UK, Germany, Italy, and Spain. France, in particular, remains the most visited country globally, welcoming 89.4 million tourists last year.

American tourists are also spending more on their European vacations, with the average vacation package costing 31% more in 2023 compared to 2019. This increase in expenditure highlights the enduring allure of Europe’s multifaceted attractions and the willingness of travelers to invest in memorable experiences.

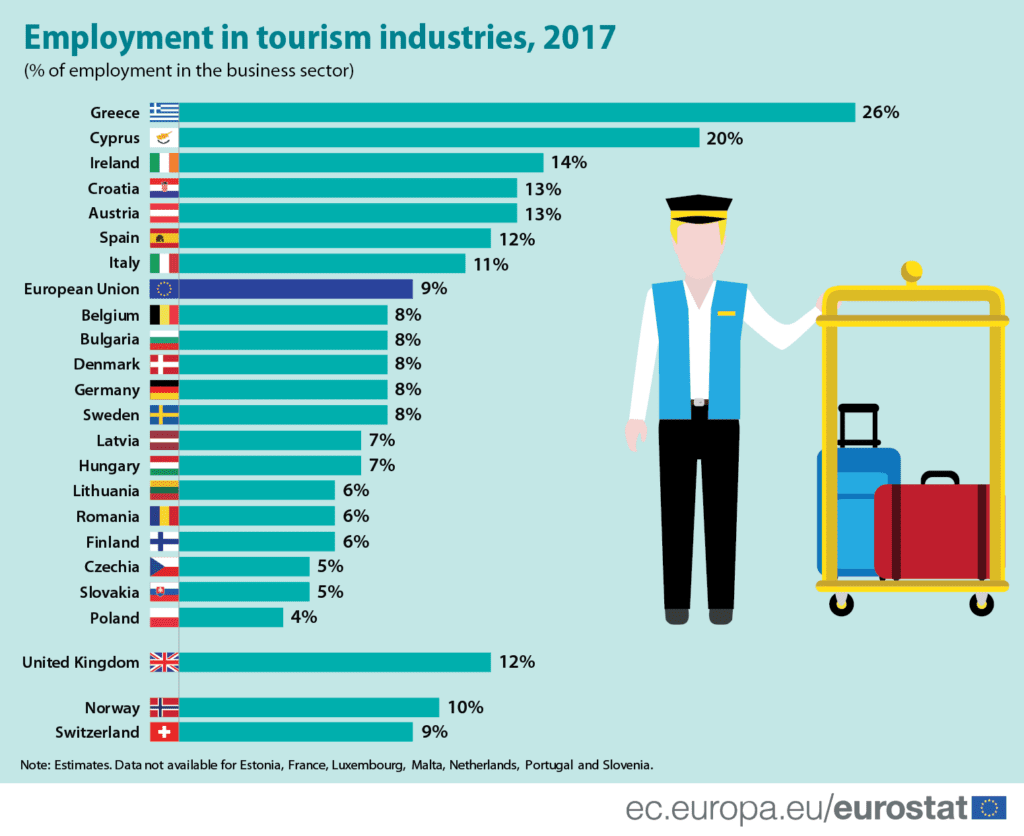

Regional Tourism Performance in EU Countries

Regional tourism performance across EU countries showcases significant variations. Southern Europe leads the pack, receiving 193 million tourist arrivals, followed by Western Europe with 171 million, Northern Europe with 66 million, and Central and Eastern Europe with 70 million. The Balkan region, in particular, is experiencing a remarkable surge in international arrivals. Serbia has seen a staggering 99% increase in visitors, while Albania has witnessed a 77% rise.

These figures underscore the growing appeal of Eastern Europe and the Balkans, as travelers seek new and exciting destinations beyond the traditional Western European hotspots. This trend is likely to continue, driven by the region’s unique cultural offerings and competitive pricing.

Accommodation Trends

Hotels Still Reign Supreme

With 44% of total bed-places in the EU, hotels remain the go-to choice, particularly for short city breaks and business trips. Tourist accommodation plays a critical role in the tourism industry’s overall contribution to GDP, with hotels being a major component. Leading hotel chains have reported strong bookings in summer 2023, reflecting increased traveler confidence.

Rise of Airbnb and Camping

Alternative lodging options—including Airbnb properties and campsites—saw an upswing during and post-pandemic, favored by travelers seeking less-crowded, more flexible accommodations. Camping, which saw an 8% pre-2020 boost, continues to grow as travelers embrace the open-air lifestyle.

Travel Motivations

Leisure, Culture, and Heritage

A solid majority (around 61% of arrivals) come to Europe for holiday, recreation, or cultural pursuits. Iconic cities like Paris, Rome, and London remain top draws, but nature destinations—from Scandinavian fjords to the Swiss Alps—have also rebounded strongly, often buoyed by demand for outdoor experiences. Despite economic challenges, many travelers still plan to travel long haul, seeking unique and distant experiences.

Business and “Bleisure”

Business travel is regaining steam. Corporations are gradually resuming in-person conferences, and many business travelers now extend stays or incorporate remote work, reflecting the bleisure trend.

Challenges and Opportunities in European Tourism

The European tourism industry faces several challenges and opportunities as it moves forward. Addressing overtourism, enhancing sustainability, and improving the overall tourist experience are critical areas of focus. The industry must also adapt to changing consumer preferences and evolving economic pressures.

A recent report indicates a decline in the share of US travelers planning a European vacation, dropping from 45% in 2024 to 37% in 2025, with cost being the primary factor. However, there is a silver lining as Chinese travelers show a growing interest in European trips, with 61% planning to holiday in Europe within the next 12 months. This shift presents a significant opportunity for European countries to tap into new markets and diversify their tourism revenue streams.

By addressing these challenges and capitalizing on emerging opportunities, the European tourism industry can continue to thrive and evolve, ensuring a sustainable and prosperous future.

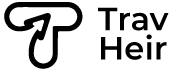

Economic Impact, Tourism Revenue, and Employment

Millions of Jobs

Tourism supports over 26 million jobs in the EU. According to the WTTC, the region’s travel and tourism sector is poised to recover close to 18 million jobs by late 2024, nearing 2019 employment figures. Domestic tourism spending significantly contributes to job creation and economic stability within the region.

Looking Beyond 2025

As Europe’s travel sector stabilizes, many of the hardest-hit regions (such as Southern Europe and the Mediterranean islands) are projected to surpass 2019 revenue benchmarks. Countries heavily reliant on tourism—like Malta and Montenegro—could see notable GDP growth as visitor numbers and spending climb.

Final Thoughts

Post-pandemic Europe has proven resilient, with tourist arrivals and spending rebounding at a faster pace than many analysts predicted in 2020. The recovery of tourism is not only vital for Europe but also plays a significant role in driving global economic growth.

This year, the continent is on track to reach or exceed pre-pandemic levels, driven by robust domestic travel, renewed long-haul interest, and evolving traveler preferences. From modern cityscapes to timeless cultural landscapes, Europe continues to offer a wealth of experiences—and the data suggests its tourism industry is poised for a dynamic, sustainable comeback.

Frequently Asked Questions (FAQ) About Tourism in Europe 2025

What is the tourism forecast for Europe in 2025?

The tourism forecast for Europe in 2025 is highly optimistic. Industry experts predict that Europe will not only recover to pre-pandemic levels but may also exceed the 2019 tourist arrival numbers. The European Travel Commission anticipates a strong rebound, driven by increased international tourist arrivals and a resurgence in domestic tourism spending across European countries.

Has tourism increased in Europe?

Yes, tourism in Europe has shown a significant increase since the pandemic setbacks of 2020. By 2023, tourist arrivals had rebounded to approximately 80% of pre-pandemic levels. The upward trend is expected to continue, with many European destinations nearing or surpassing 2019 figures by 2025.

Are more Americans going to Europe?

American tourists are gradually returning to Europe, with inbound arrivals from the U.S. reaching 85% of 2019 levels by summer 2023. Although there has been a slight decline in long-haul travel intentions, Europe remains a popular destination for American travelers, who are spending more on their vacations compared to previous years.

Which country in Europe receives the most tourists each year?

France holds the title of the most visited country in Europe and globally, welcoming 89.4 million tourists last year. Spain, Italy, and Germany also rank among the top European destinations, attracting millions of international visitors annually.

What are the emerging tourism trends in Europe for 2025?

Emerging tourism trends in Europe for 2025 include a rise in budget-friendly itineraries, second-city tourism, and workation setups. Travelers are increasingly seeking value-oriented experiences, sustainable travel options, and destinations that offer a blend of work and leisure opportunities.

How is Europe addressing tourism challenges?

Europe is addressing tourism challenges by focusing on sustainability, managing overtourism, and enhancing the tourist experience. The industry is adapting to changing consumer preferences and economic pressures, with a growing emphasis on attracting new markets, such as Chinese travelers, to diversify tourism revenue streams.