The global car rental market is on the road to recovery and growth, particularly following the challenges brought on by the pandemic. With key players driving innovation and increasing user interest, car rentals are becoming a more integral part of the travel and transport industry.

In this blog, we’ll explore key statistics and trends shaping the industry, giving you a detailed look into the future of car rentals.

What is the Car Rental Market Penetration Rate?

The car rental industry is experiencing a steady increase in its penetration rate, particularly in the aftermath of the pandemic. Back in 2017, the global penetration rate for car rentals stood at 5.7%, but the industry took a significant hit in the subsequent years. In 2020, as the world faced travel restrictions and lockdowns, the penetration rate plummeted to just 3.8%. This was the lowest point for the industry in recent years.

However, from 2021 onwards, the sector has seen a remarkable recovery. The penetration rate rose to 5.6% that year, signaling the return of travel demand, and this growth trend is expected to continue through the next decade. By 2029, the car rental penetration rate is forecasted to reach an impressive 10.1%.

This increase can be attributed to several factors, including the easing of travel restrictions, growing urbanization, and a shift in consumer behavior towards more flexible and on-demand transportation solutions.

User Numbers: From Setbacks to Surge

The pandemic did more than just lower the penetration rate; it also caused a sharp decline in the number of car rental users worldwide. In 2017, the market boasted 0.41 billion users, and by 2019, this number had risen to 0.45 billion.

But, in 2020, user numbers dropped to 0.28 billion, largely due to travel restrictions and economic uncertainty caused by COVID-19. However, similar to the penetration rate, the user base has been steadily recovering since 2021, and the market is expected to experience a sustained period of growth in the coming years. By 2029, the number of users is projected to climb to 0.82 billion—nearly doubling its post-pandemic low.

This increase reflects the broader trend of consumers opting for more flexible transportation options, including short-term rentals, which align well with changing lifestyles and travel preferences.

Major Players in the Car Rental Industry

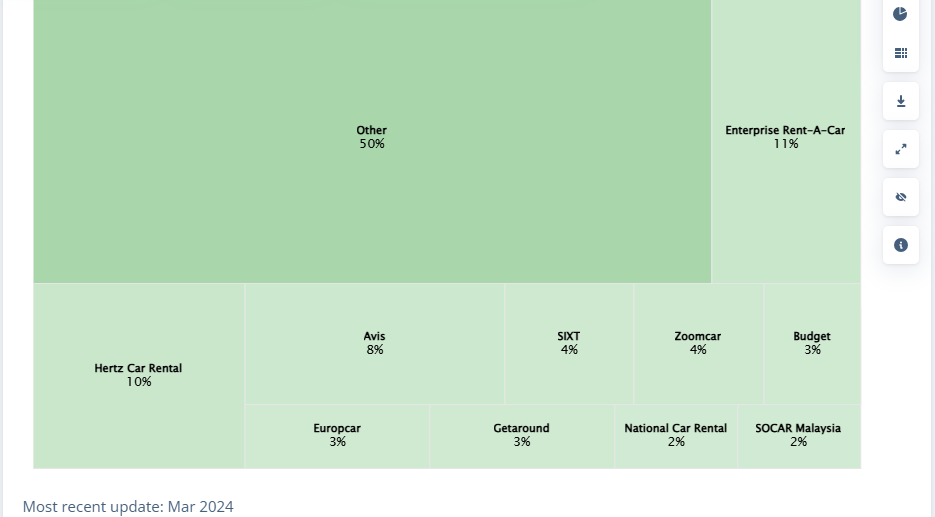

The global car rental market is highly competitive, with a mix of established giants and smaller, regional players. Enterprise Rent-A-Car leads the pack, commanding 11% of the total market share. Right behind Enterprise is Hertz Car Rental, with 10%, followed by Avis with 8% of the market.

Smaller companies such as SIXT and Zoomcar hold 4% of the market each, while Budget, Europcar, and Getaround each occupy around 3%. Other notable names, like National Car Rental and SOCAR Malaysia, account for 2% of the market share apiece.

However, despite the dominance of these larger players, the market remains highly fragmented. A significant 50% of the market is captured by “Other” companies, including smaller, local, or regional car rental businesses. This suggests that there is ample room for new entrants and niche players to carve out their share of the growing market.

What’s Driving the Growth?

The growth of the car rental industry can be attributed to several factors:

- Post-Pandemic Travel Boom: As global travel restrictions ease, tourists and business travelers alike are turning to car rentals as a flexible and convenient option for local transportation.

- Urbanization: With more people moving to cities, the demand for flexible transport options is on the rise. Many urban dwellers prefer renting cars on-demand rather than owning a vehicle, particularly in densely populated areas.

- Technological Advancements: Digital platforms, mobile apps, and innovations like car-sharing services have made renting a car easier than ever. These technologies allow users to book a car in just a few clicks, enhancing the overall customer experience.

- Sustainability: The car rental industry is also adopting greener practices, including offering electric and hybrid vehicles, which appeals to environmentally conscious consumers. This trend is expected to gain momentum as more people seek sustainable travel solutions.

What does the Future Hold for the Car Rental Market

Looking forward, the global car rental market is poised for sustained growth. The user base and penetration rate are both expected to rise significantly over the next decade, driven by evolving consumer preferences, advancements in technology, and growing urban populations. By 2029, both the penetration rate and user numbers are expected to nearly double compared to their lowest points in 2020.

For businesses operating in or looking to enter the car rental market, the opportunities are vast. Whether you’re an established player like Enterprise or Hertz, or a smaller, regional player, the future of car rentals looks bright. With market fragmentation still significant, there’s room for innovation and new services to thrive.

A Booming Industry on the Horizon

Despite the setbacks brought on by the pandemic, the global car rental market has not only recovered but is on track to grow stronger in the coming years. With a projected increase in both penetration rate and user numbers, the industry offers numerous opportunities for businesses to expand and innovate.

If you’re considering using car rentals for your travel needs, or if you’re in the industry yourself, now is the time to take advantage of the growing demand and the exciting developments on the horizon.